August at-a-glance … materials & handling

NAFEM and allied associations continue to advocate for supply chain relief

The collation of NAFEM, the Association of Home Appliance Manufacturers (AHAM), Air-Conditioning, Heating and Refrigeration Institute (AHRI) and National Electrical Manufacturers Association (NEMA) continues to meet with elected and appointed officials to advocate for relief to supply chain issues caused by tariffs, shipping challenges and other supply chain-related issues facing members. The group met with the House Committee on Science, Space and Technology minority staff Aug. 2 to discuss the semiconductor shortage. And Aug. 3, staff from the associations met with United States Trade Representative (USTR) staff and asked them to lift or review the Section 301 tariffs on imported steel and aluminum.

“The group is now working on a supply chain impact white paper to further articulate the pressures supply chain issues are having on the U.S. manufacturing sector, including jobs,” said NAFEM’s Vice President, Regulatory & Technical Affairs Charlie Souhrada, CFSP.

GAO calls on USTR to fully document tariff-related decisions

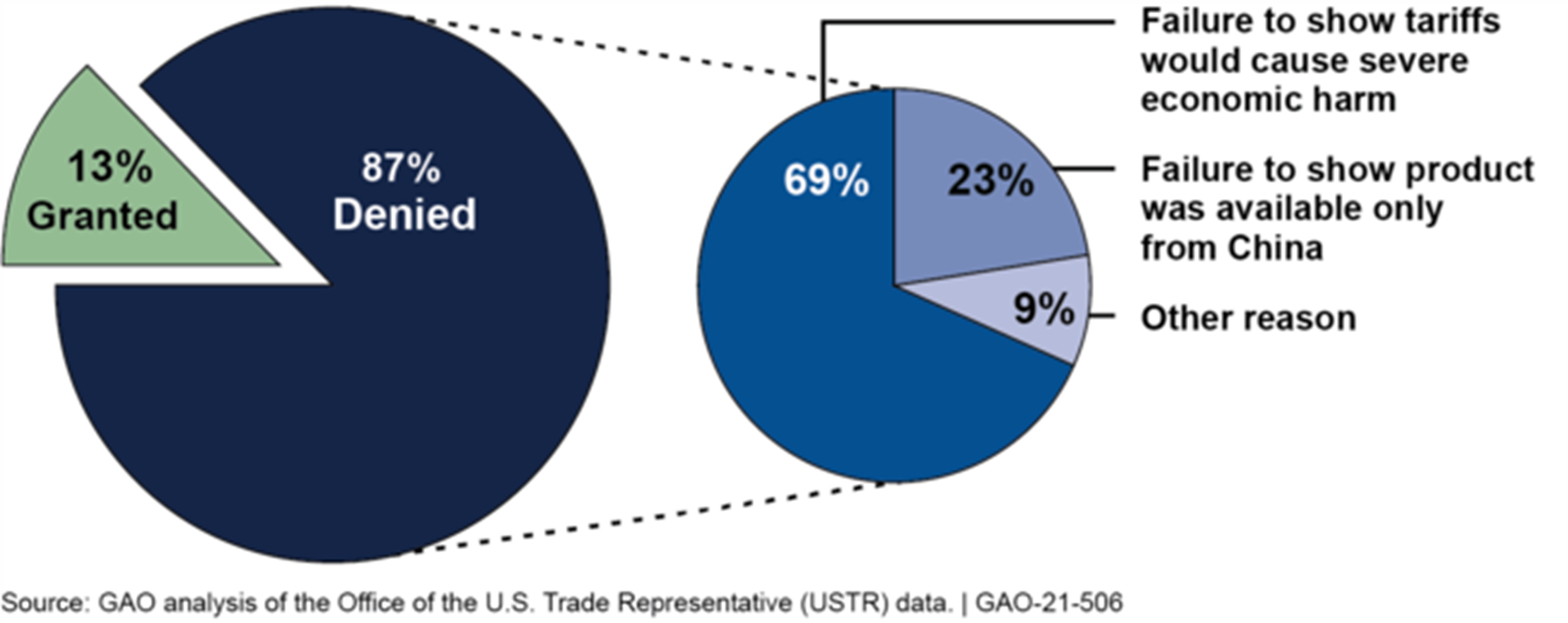

The Government Accountability Office’s (GAO) recently completed review of the USTR procedures for making tariff exclusion and extension decisions called on the trade organization to fully document all of its internal procedures for each step in its review process. “Without fully documented internal procedures, USTR lacks reasonable assurance it conducted its reviews consistently. Moreover, documenting them will help USTR to administer any future exclusions and extensions.”

In its review, GAO also identified USTR’s primary reasons for denying Section 301 exclusion requests.

USTR’s Primary Reasons for Denying Exclusion Requests for Section 301 Tariffs on Products from China, 2018-2020

Xinjiang supply chain concerns continue

On July 13, 2021, the U.S. Departments of State, Treasury, Commerce, Labor and Homeland Security, along with the USTR, issued an updated Xinjiang Supply Chain Business Advisory highlighting the heightened risks for businesses with supply chain and investment links to Xinjiang. “The People’s Republic of China government continues its horrific abuses in the Xinjiang Uyghur Autonomous Region and elsewhere in China, targeting Uyghurs, ethnic Kazakhs, and ethnic Kyrgyz, who are predominantly Muslim, and members of other ethnic and religious minority groups. Given the severity and extent of these abuses, businesses and individuals that do not exit supply chains, ventures and/or investments connected to Xinjiang could run a high risk of violating U.S. law.”

One day later, the Senate unanimously passed the Uyghur Forced Labor Prevention Act to ban the import of products from China’s Xinjiang region. The House of Representatives passed a similar bill in 2020. It still needs to act on the more recent Senate bill.

“These actions point to the continued necessity to thoroughly know your supply chain,” said Nicholas Galbraith, NAFEM legal counsel, Barnes & Thornburg. “Consider audits, certifications and ongoing training of both suppliers and your internal teams, particularly in China.”

Business leaders back vaccination of port workers to prevent COVID outbreak

Quarterly, the 45-member Advisory Committee on Supply Chain Competitiveness meets to advise the U.S. Secretary of Commerce on national freight infrastructure and freight policy issues to support U.S. supply chain and export competitiveness. This group, comprised of business leaders from multiple sectors, is chartered to “support U.S. export growth and national economic competitiveness, encourage innovation, facilitate the movement of goods, and improve the competitiveness of U.S. supply chains for goods and services in the domestic and global economy.”

The Committee’s most recent recommendation stressed the importance of “ensuring that the front-line workers that serve America’s ports of entry are fully vaccinated against COVID. As American companies quickly replenish their inventories to meet renewed consumer demand, cargo volumes are reaching record levels at our land, sea and airports. Any surge of COVID infection in our port of entry workforce could potentially cripple the flow of commerce and compound the severe delays and costs that this congestion is already imposing on our supply chains and consumers.”